How can automotive heat pump air conditioning enterprises maintain technological leadership in the boom of new energy vehicles?

With increasing global emphasis on environmental protection and sustainable development, the new energy vehicle (NEV) industry is flourishing at an unprecedented pace. Against this backdrop, the automotive heat pump air conditioning (HPAC) market has also ushered in unprecedented development opportunities.

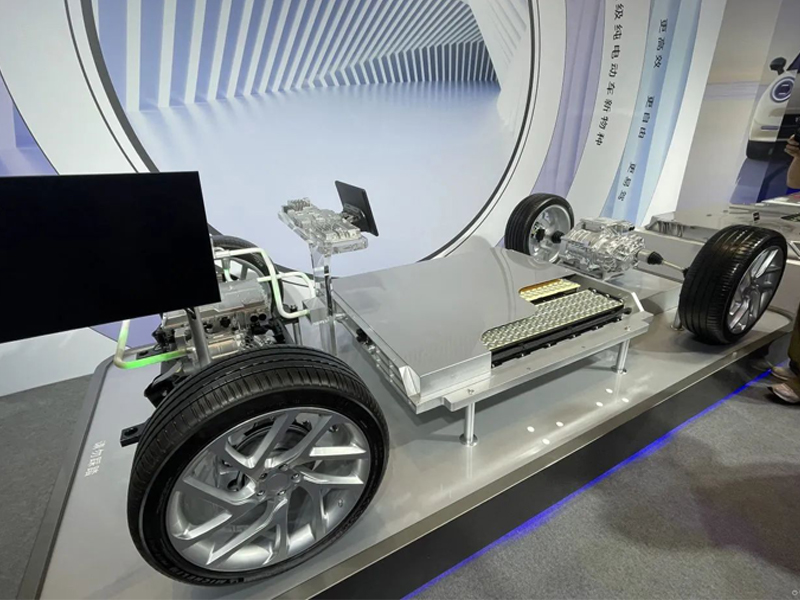

It is understood that automotive heat pump air conditioning (HPAC) is a sub-segment of automotive thermal management and represents one of the development directions for air conditioning systems. It primarily functions to provide heating in the passenger compartment during winter and is considered the mainstream of future automotive air conditioning systems. So, what exactly are the development potentials of automotive heat pump air conditioning?

01 Market penetration rate continues to increase

The rapid development of new energy vehicles (NEVs) has provided vast opportunities for the automotive heat pump air conditioning (HPAC) market. As a key component of the thermal management system in NEVs, the importance of HPAC is increasingly prominent. Currently, the air conditioning systems in NEVs are mainly categorized into two types: positive temperature coefficient (PTC) air conditioning and heat pump air conditioning. PTC air conditioning heats the air directly by passing electric current through a resistor, which is simple in principle and low in cost, but its coefficient of performance (COP) is limited, affecting the driving range of NEVs. In contrast, heat pump air conditioning drives the refrigerant to reflow with a small amount of electric energy, bringing external heat into the vehicle, resulting in a COP far exceeding that of PTC air conditioning and effectively extending the winter driving range.

Heat pump air conditioning (HPAC) technology was first applied in foreign brand vehicles, and its application in passenger cars is relatively mature. With the continuous maturation of domestic electric vehicle heat pump air conditioning technology and the improvement of product quality, an increasing number of domestic enterprises have begun exporting their products to overseas markets.

As the new energy vehicle (NEV) market continues to expand, the penetration rate of heat pump air conditioning (HPAC) systems is gradually increasing. According to predictions by CITIC Securities, the global HPAC market for NEVs had reached a certain scale in 2022 and is expected to achieve significant growth this year. This trend indicates that the automotive HPAC market is entering a golden period of development.

02Policy Support and Market Drive

Governments around the world have been increasing their support for the new energy vehicle (NEV) industry, implementing policy measures such as exempting vehicle purchase taxes and offering subsidies for car purchases, which have further stimulated the consumption of NEVs. These policies not only drive the rapid development of the NEV market but also provide a favorable external environment for the automotive heat pump air conditioning (HPAC) market.

With the continuous innovation and upgrading of heat pump air conditioning (HPAC) technology, significant improvements have been made in product efficiency, stability, and comfort. Meanwhile, the deep integration with thermal management systems and battery management systems of new energy vehicles (NEVs) has further optimized the performance of HPAC and enhanced the market competitiveness of the products.

As consumers' awareness of new energy vehicles (NEVs) increases and their environmental consciousness strengthens, the demand for efficient, energy-saving, and environmentally friendly automotive heat pump air conditioning (HPAC) is also on the rise. This trend will drive the continuous expansion of the automotive HPAC market.

03The competition in the automotive heat pump air conditioning (HPAC) market is fierce.

The major global manufacturers of automotive electric compressors for air conditioning systems include Denso, Sanden, and Hanon Systems. In the Chinese market, giants in the traditional HVAC (heating, ventilation, and air conditioning) field such as Haier, Midea, and Gree have all made strategic moves into the heat pump market and occupy a significant market share. Meanwhile, a number of specialized enterprises focused on heat pump R&D and production have also emerged, such as Zhongguang Outes, Phnix, and New Energy.

The distribution of market share is influenced by various factors, including brand influence, product quality, and after-sales service. For instance, Denso holds a 37.4% market share in the global automotive air conditioning system market. In the electric vehicle heat pump air conditioning market, domestic brands such as BYD, SAIC, Changan, NIO, Xiaomi, and XPeng are also actively expanding their presence and continuously increasing their market share.

Technological innovation and product upgrading are at the core of competition in the heat pump air conditioning market. With continuous technological advancements, the energy efficiency ratio of heat pump products will further improve, and their performance will become even superior. The application of technologies such as intelligence and networking will further enhance user experience. For example, the application of low-temperature vapor injection enthalpy enhancement technology and new refrigerants in heat pumps has enabled their minimum operating temperature to drop to -25°C, gradually popularizing them in northern regions.

Although the prospects for the automotive heat pump market are vast, it still faces significant challenges, such as: high initial investment costs, where the relatively high upfront costs of heat pump air conditioning products may limit the purchasing willingness of some consumers; technical difficulties that remain to be resolved, as despite continuous advancements in heat pump technology, challenges such as reduced operational efficiency in low-temperature or high-humidity environments, frost formation in low-temperature conditions, and high noise levels still need to be addressed; and the need for improved market regulations, as the rapid development of the heat pump air conditioning industry has outpaced the establishment of comprehensive market standards. The performance and reliability of products from some smaller brands need improvement, and installation and maintenance require professional technicians, which to some extent restricts the popularization of heat pump air conditioning products.

With increasing global emphasis on energy conservation, emission reduction, and environmental protection policies, as well as the rapid development of the new energy vehicle market, the demand for heat pump air conditioning systems will continue to grow. The application scope of these systems will also gradually expand to traditional fuel vehicles, commercial vehicles, and other sectors.

In the face of a highly competitive market environment, automotive heat pump air conditioning enterprises need to continuously enhance their technological research and development capabilities and innovation abilities, strengthen supply chain management, and improve market expansion capabilities, in order to cope with intense market competition and meet the diverse needs of consumers.

![[Countdown 1 Day] Preview of the 2024 Gehua International Automotive Air Conditioning Exhibition Guangzhou Station!](https://up.v2.wzjcsw.com/upload/images/2025/03/07/60353151353.jpg)